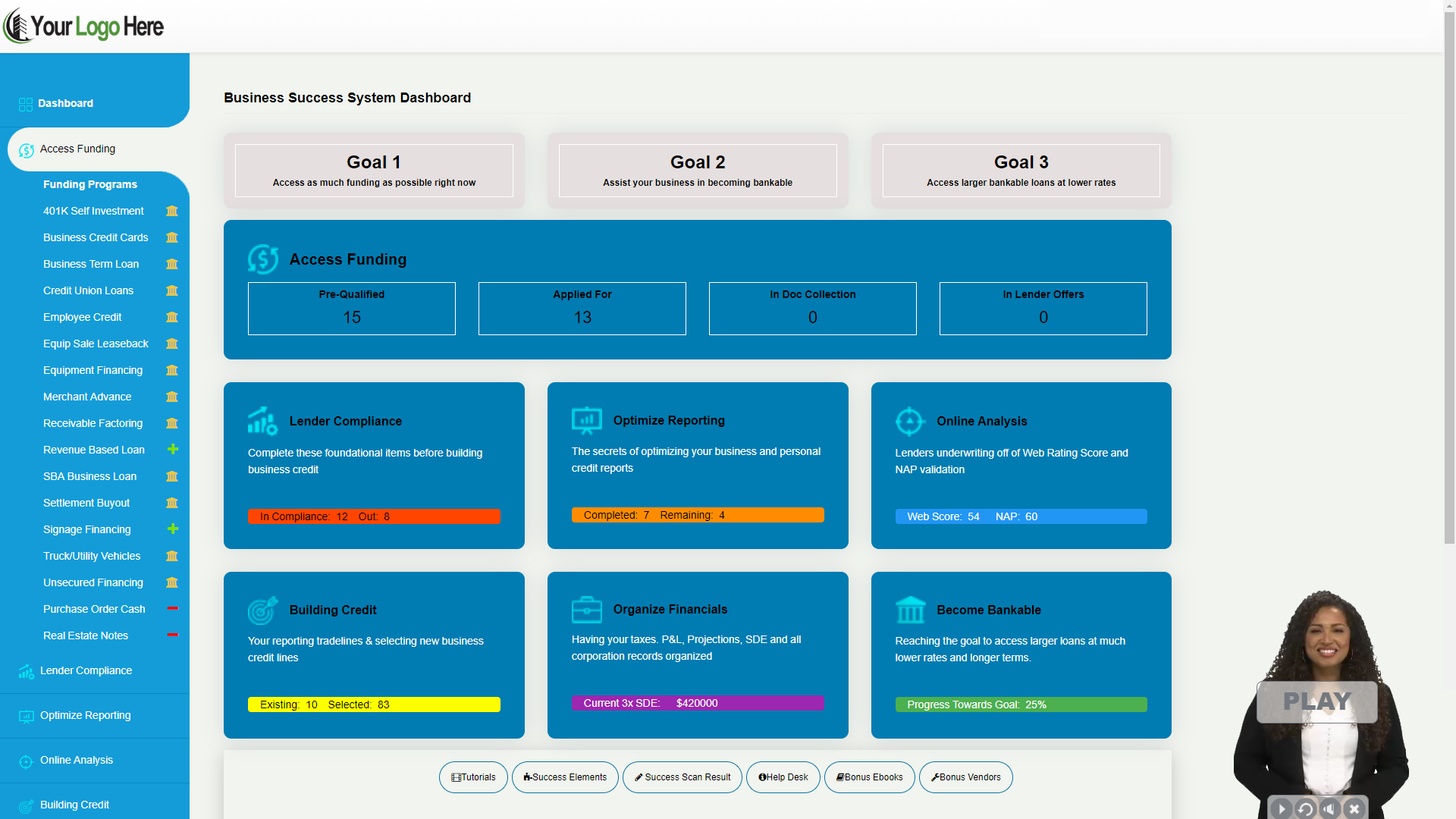

Business Financing Pre-Qualification

The private label has a two part business finance prequalification system. The first part are "pre-bankable" funding programs that are typically called "alternative financing". These are smaller fundings with higher interest rates and shorter repayment terms. The second park are "bankable" funding program that are typically much larger loans, at much lower interest rates and much longer repayment terms.