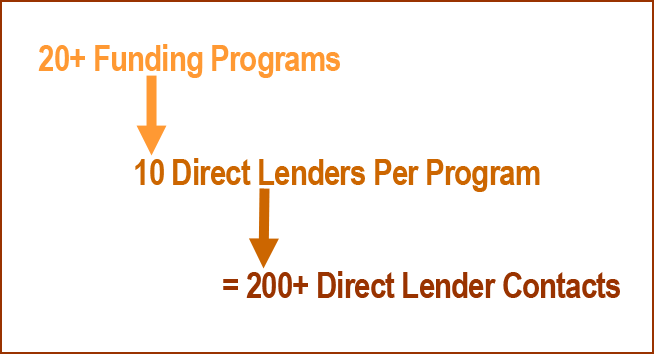

Over Twenty Business Funding Programs

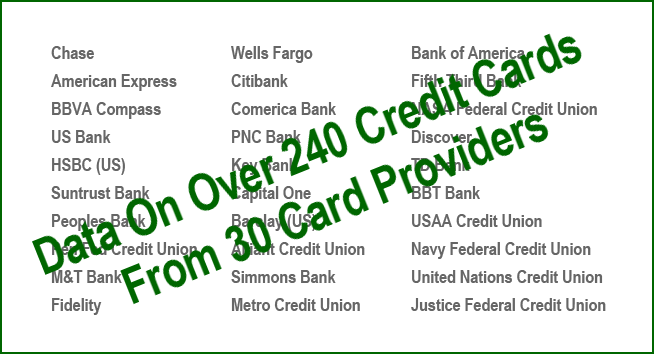

Inside the OwnersPath private label business finance pre-qualification and become bankable system there are over twenty (20) business funding programs. Initially these are what is called "non-bankable" or "alternative" business funding programs such as; credit cards, revenue based loans, merchant account advances, receivables factoring, purchase order financing, business owner credit based term loans, contract financing, asset based lending, commercial real estate financing and more. These alternative type business financing programs do not require your clients to be "bankable" because they are designed to serve higher risk of default small businesses that are not yet bankable. Once your clients utilize the resources and instructions in your private label to become bankable, there are many more funding programs that open up to them on more favorable terms.