Two Example Reports - Bankable Status & Funding Range

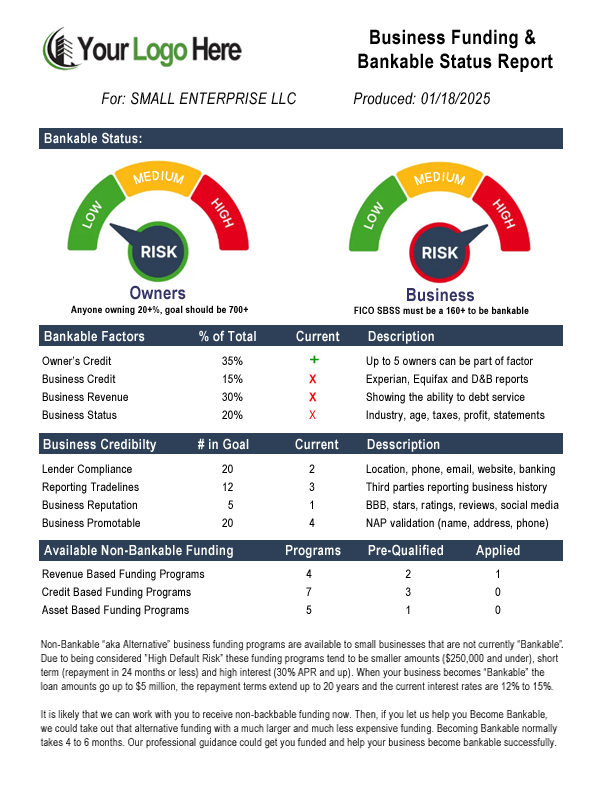

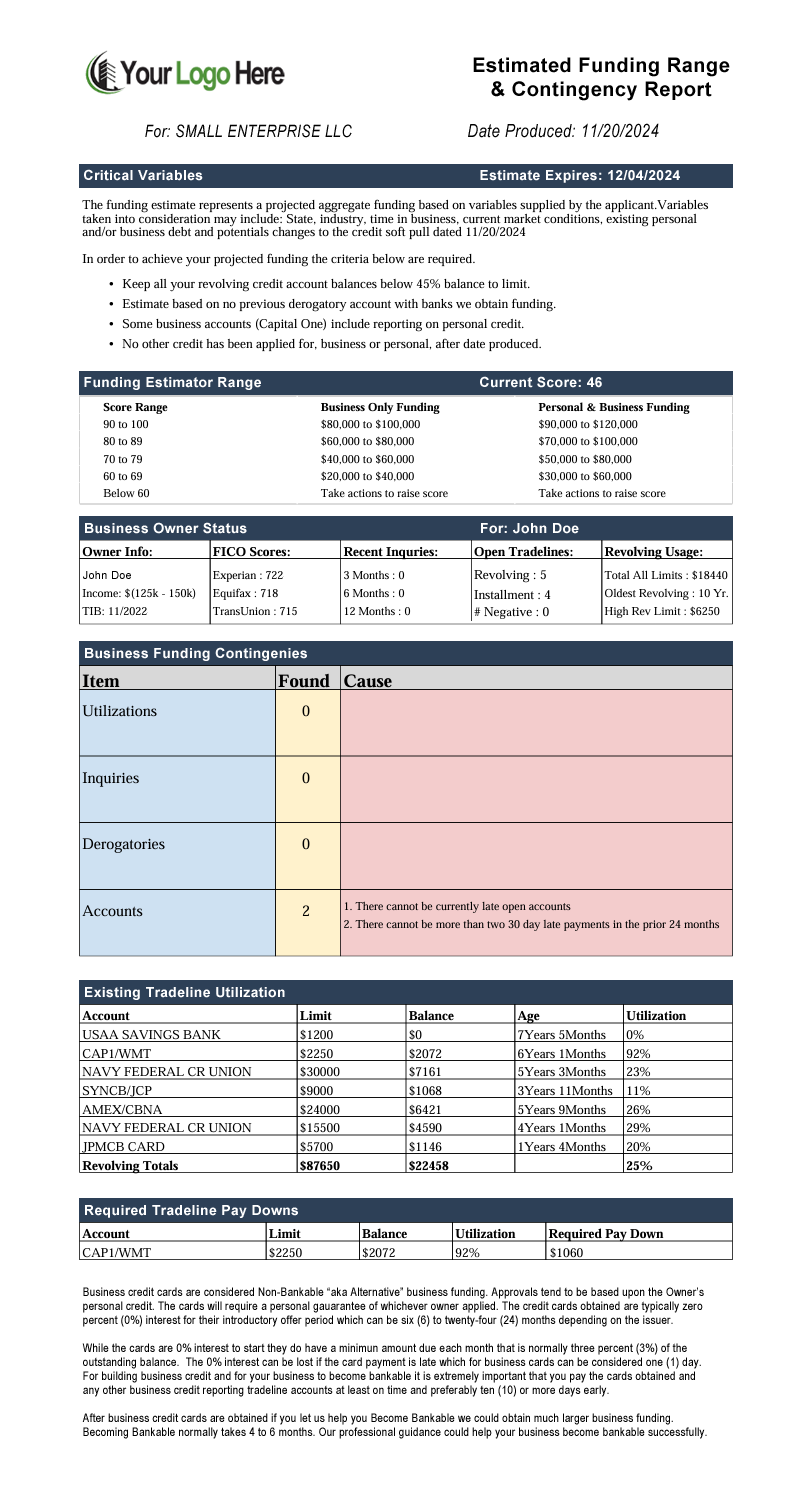

It is important that your prospects, clients and referral partners can quickly see where they stand, what is available and which items need addressing in order to be funded and to become bankable. Below are two reports included in your private label system.

- The first is the Business Funding & Bankable Status Report. This report is designed to show your prospects and clients what funding programs are available to them now and what the advaantages are between non-bankable (aka alternative) programs and bankable funding programs.

- The second is the Estimated Funding Range & Contingency Report. This report is focused on available credit card funding. It is based on integration of their personal credit report data. This report runs an algorithm to create the various shown sections. It gives your prospects an estimated range of funding and lists any contingency items that may need to be addessed before they applying for business credit cards.