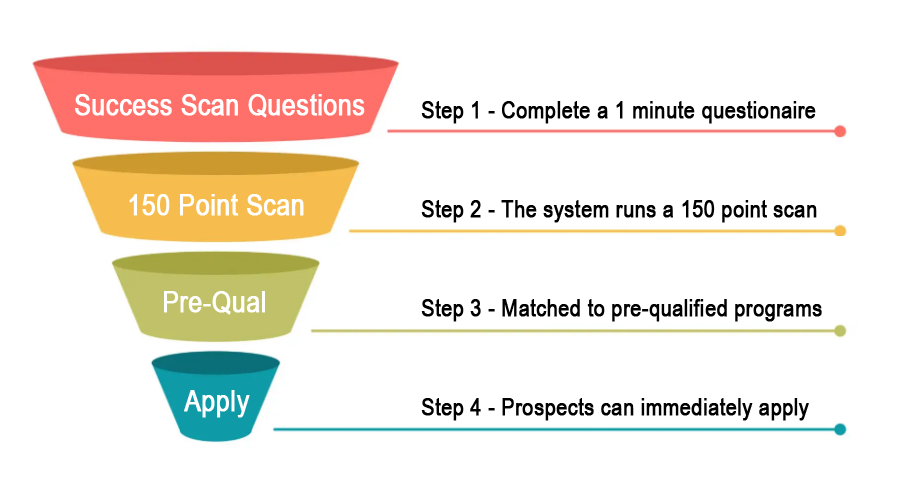

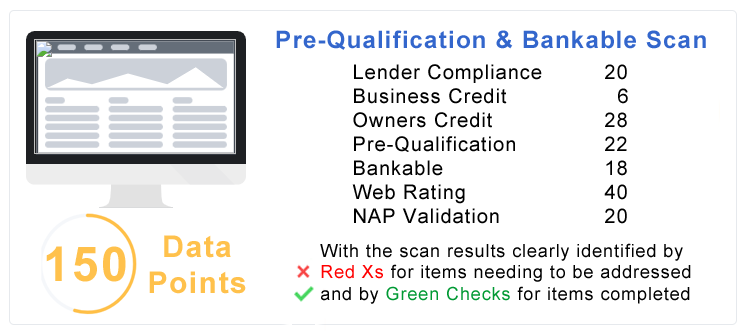

Step 1 - 150 Data Point Pre-Qualification & Bankable Scan

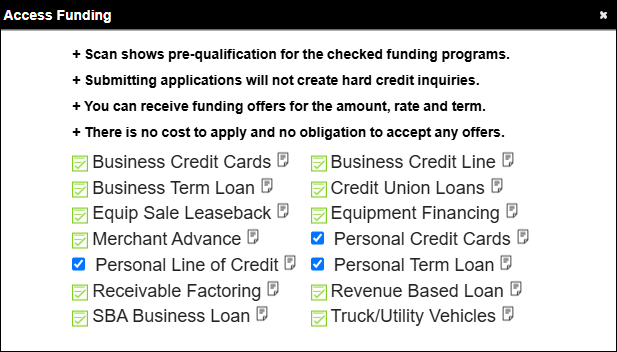

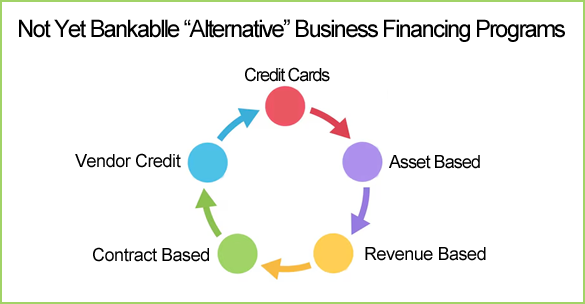

Included with your private label is the ability to run an unlimited number of business pre-qualification and bankable scans. This will scan and return the results for 150 data points on your business prospects showing them (and you) exactly which funding programs they pre-qualify for right now and where they may be coming up short on all the others. It will also display Red Xs for their become bankable items your business clients need to address and Green Checks for those items they have already completed. The scan makes a very productive lead generation tool and provides excellent result reports to assist you in turning your prospects into revenue generating clients.