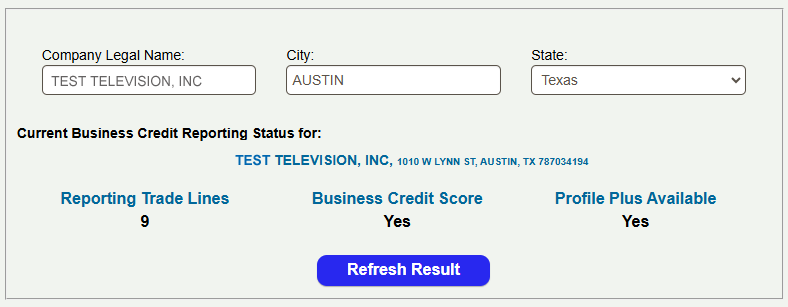

Scan Part 1 - What Is Their Business Credit Status?

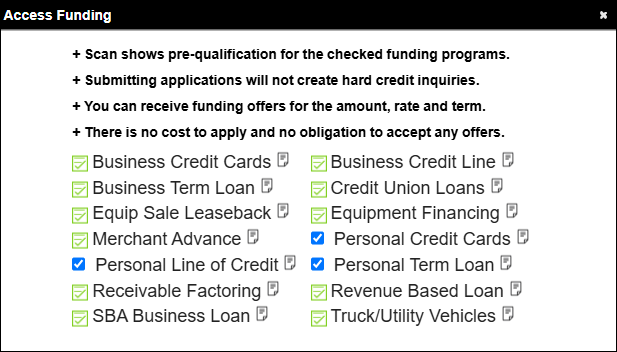

The pre-qualification scan is checking the same databases that lenders are checking. The scan searches the Experian Business Credit database to determine the following:

- Does the business have an active credit history file.

- Is the business name, entity & location listed correctly.

- How many reporting tradelines does the business have.

- Does the business have a credit score and a full profile.