The Old Guard; Experian, EquiFax, Dun and Bradstreet

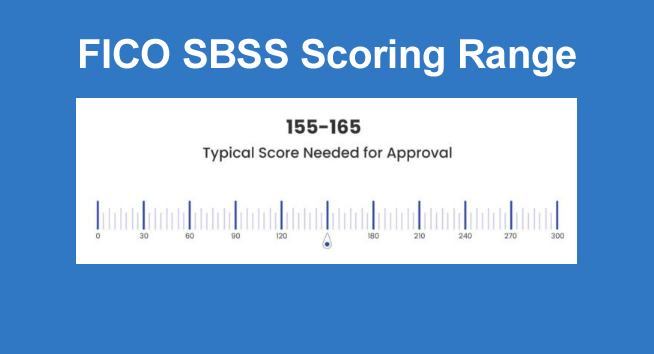

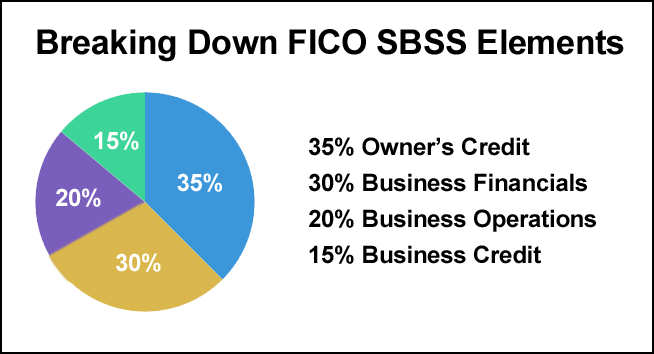

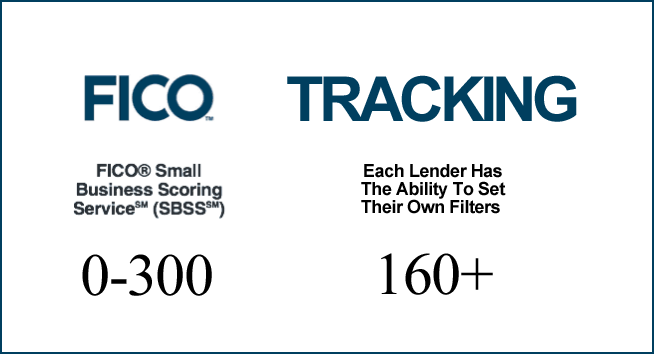

Ten years ago Experian, Equifax and D&B were the major players in business credit reports and scores. Experian's Intelliscore, Equifax's Small Business Financial Exchange and D&B's Paydex score. While those business credit agencies are still around and producing their reports and scores, the "cash lending" industry has mostly moved to FICO SBSS (Small Business Scoring Service). The Paydex score is still widely used by Vendors who are providing business to business lines of credit on Net 30 terms for their products or services, but most cash lenders such as banks, SBA loans and many others have moved to FICO SBSS.