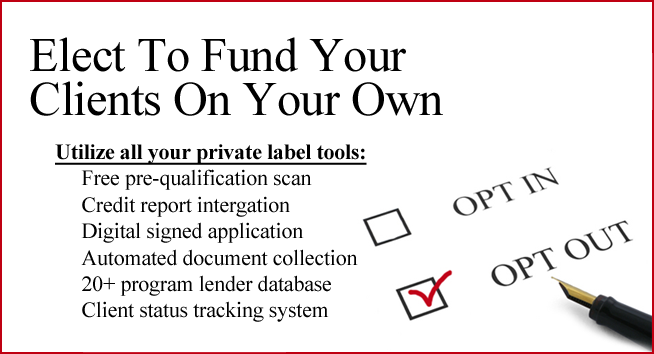

Opt-Out, Process Your Client's Fundings Yourself

Your private label system gives you the option to fund all your client's transactions on your own using all the resources of the system itself. You can use the free 150 data point scan to generate and pre-qualify prospects. You can utilize the automated application system to turn prospects into clients. You can use the automated document collection system to gather what is needed to fund those clients. And you can use the direct lender database to source the lenders you need to make those client fundings a success. In your private label software this is called "Opt-Out".