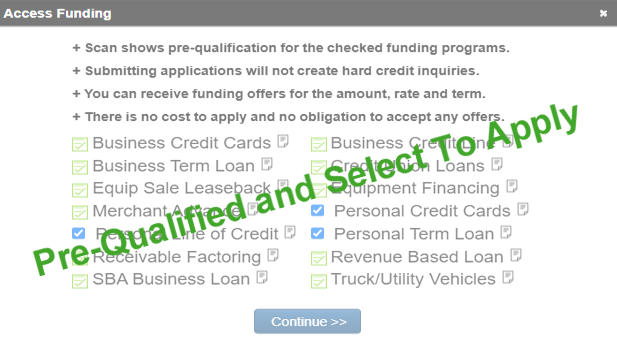

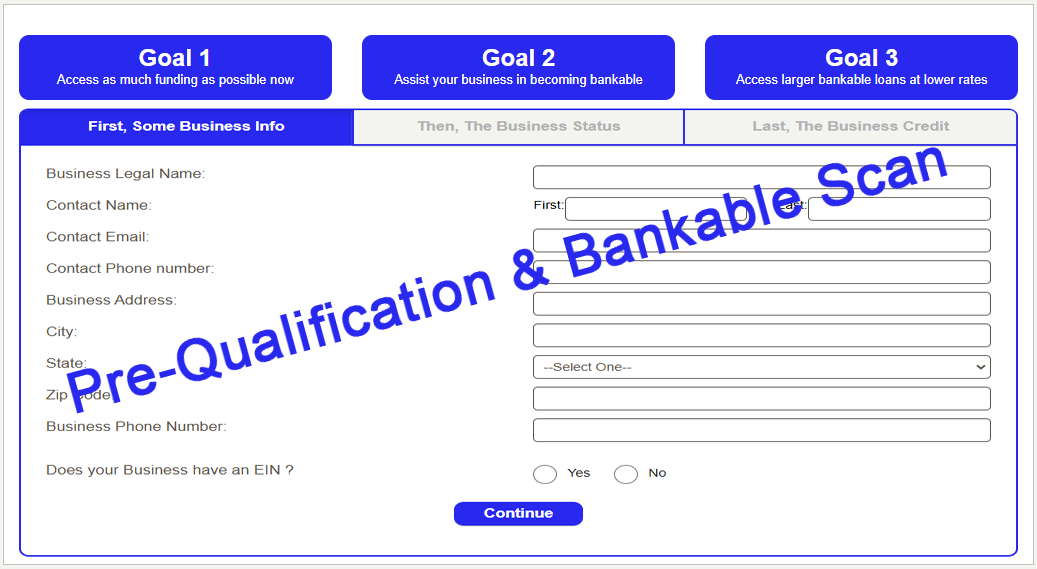

First, Your Prospects Complete A Scan

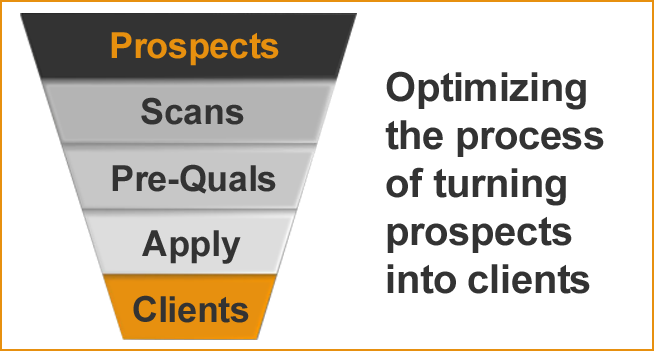

The private label system is all about automation. That automation begins with the free pre-qualification and bankable scan that your prospects can run to see which non-bankable funding programs they pre-qualify for right now and where their business is in the process of becoming bankable. Currently less than one percent (1%) of small businesses in the United States are "Bankable". How do we know that? We ran a scan on 10,000 small businesses. We made sure those businesses had been in business at least one year, that they were an in good standing LLC, that they had a physical location, that they had less than one million in annual revenue and that they had 19 or less employees. The results were that only sixty-four (64) met the criteria for being bankable. That makes a huge market for you.