The Funding Range Report

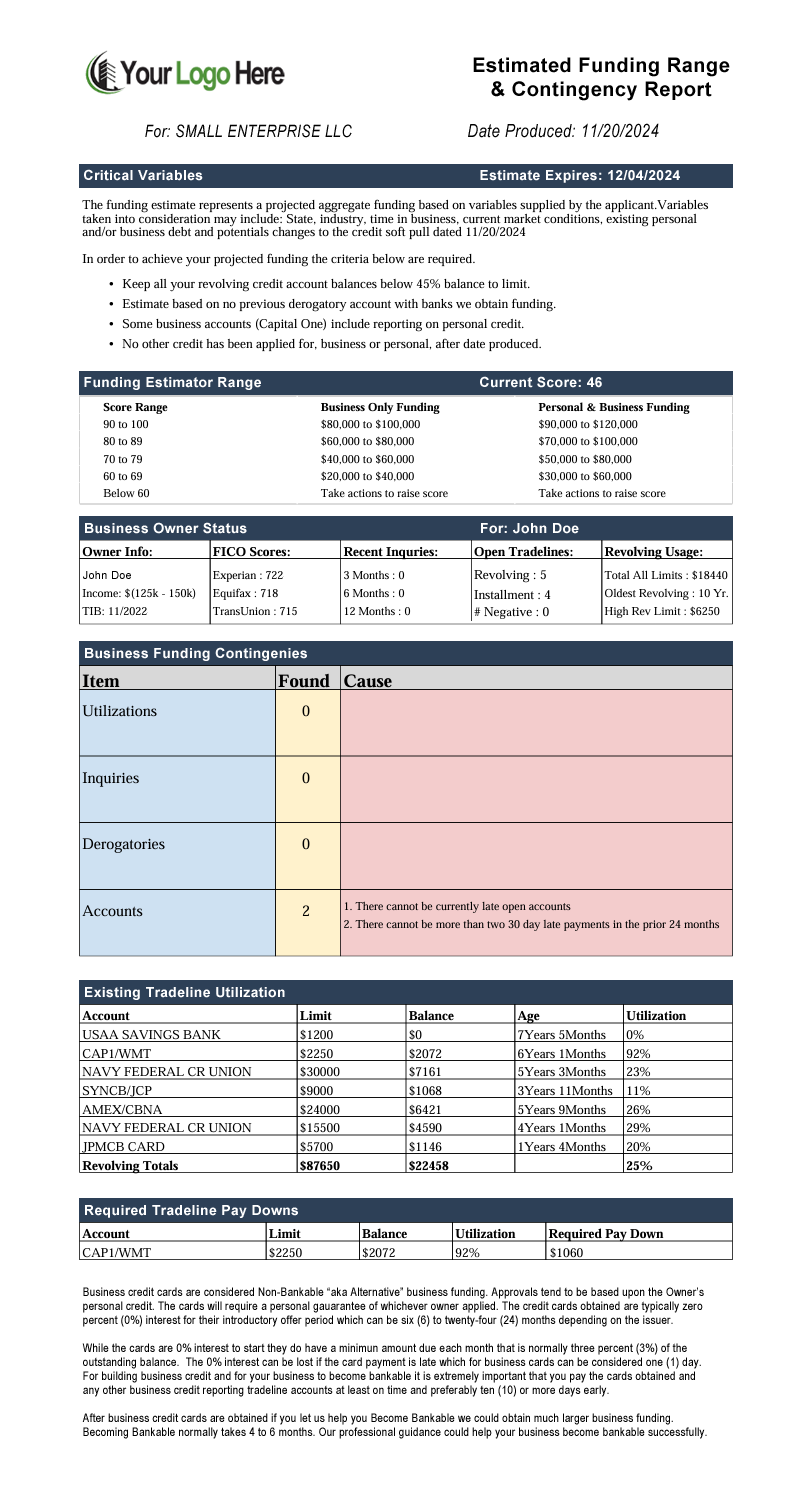

The Estimated Funding Range & Contingency Report is focused on the personal credit of the business owners and their possible available business credit card funding.

This report is auto-generated based on the API integration of their personal credit report data that includes all three personal credit reporting agencies along with their FICO 8 scores.

It is important to note that 35% of the Business FICO Score is the personal credit of anyone owning 20% or more of the business and in order to obtain a minimum 160 business FICO score all owners with 20% or more ownership must have personal FICO 8 scores of 640 or above.

This Funding Range Report runs an algorithm to create the various shown sections. It gives your prospects an estimated range of funding and lists any contingency items that may need to be addressed before applying for business credit cards and more importantly what should be done to ensure the minimum required FICO 8 scores.

This critical Funding Range Report can be generated with each completed 150 data point pre-qualification scan. You can run an unlimited number of Funding Range Reports as they are included with your private label subscription.

The personal credit report API integration from all three personal credit agencies along with your prospect’s FICO 8 scores do not cost you anything and only cost your prospects $1 to simply verify their identity.

The Funding Range Report is found inside your private label system and is an excellent prospect to client closing tool to earn you money.