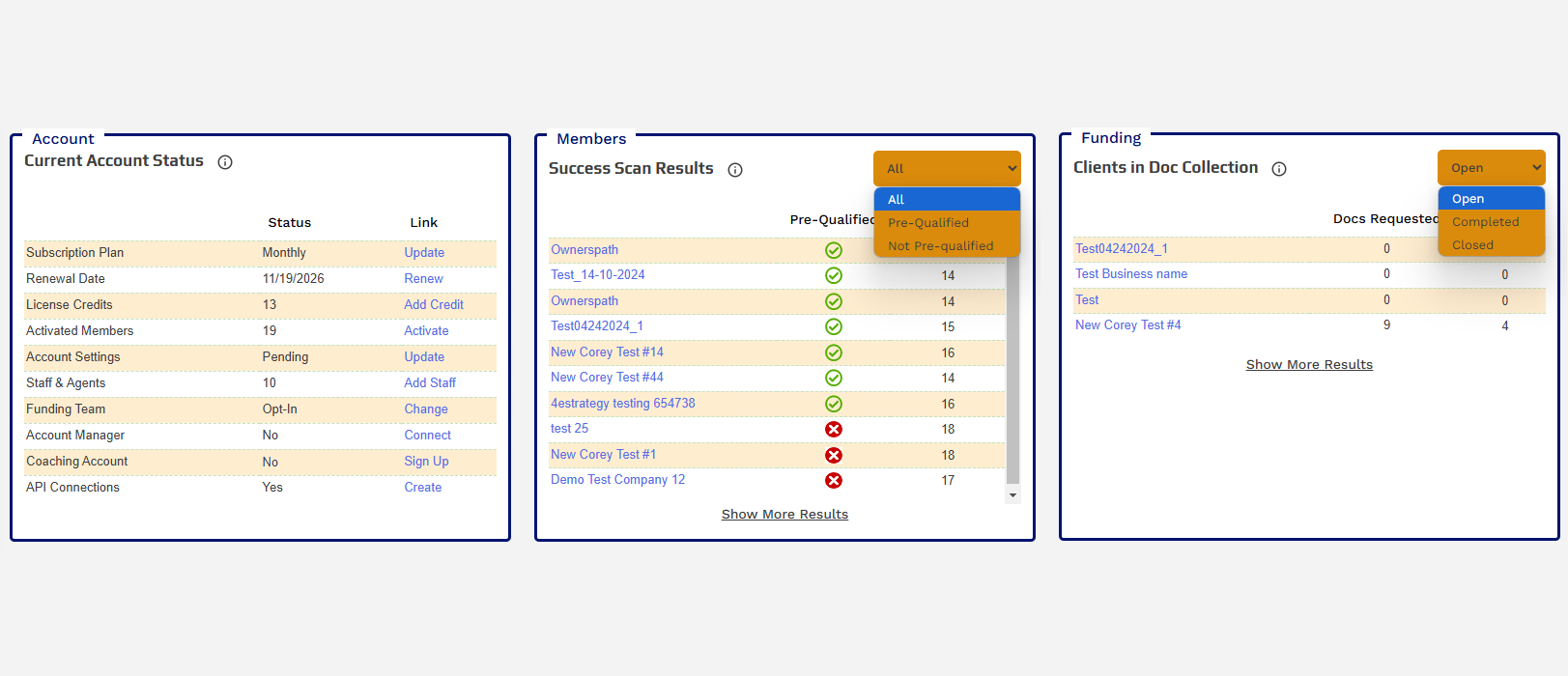

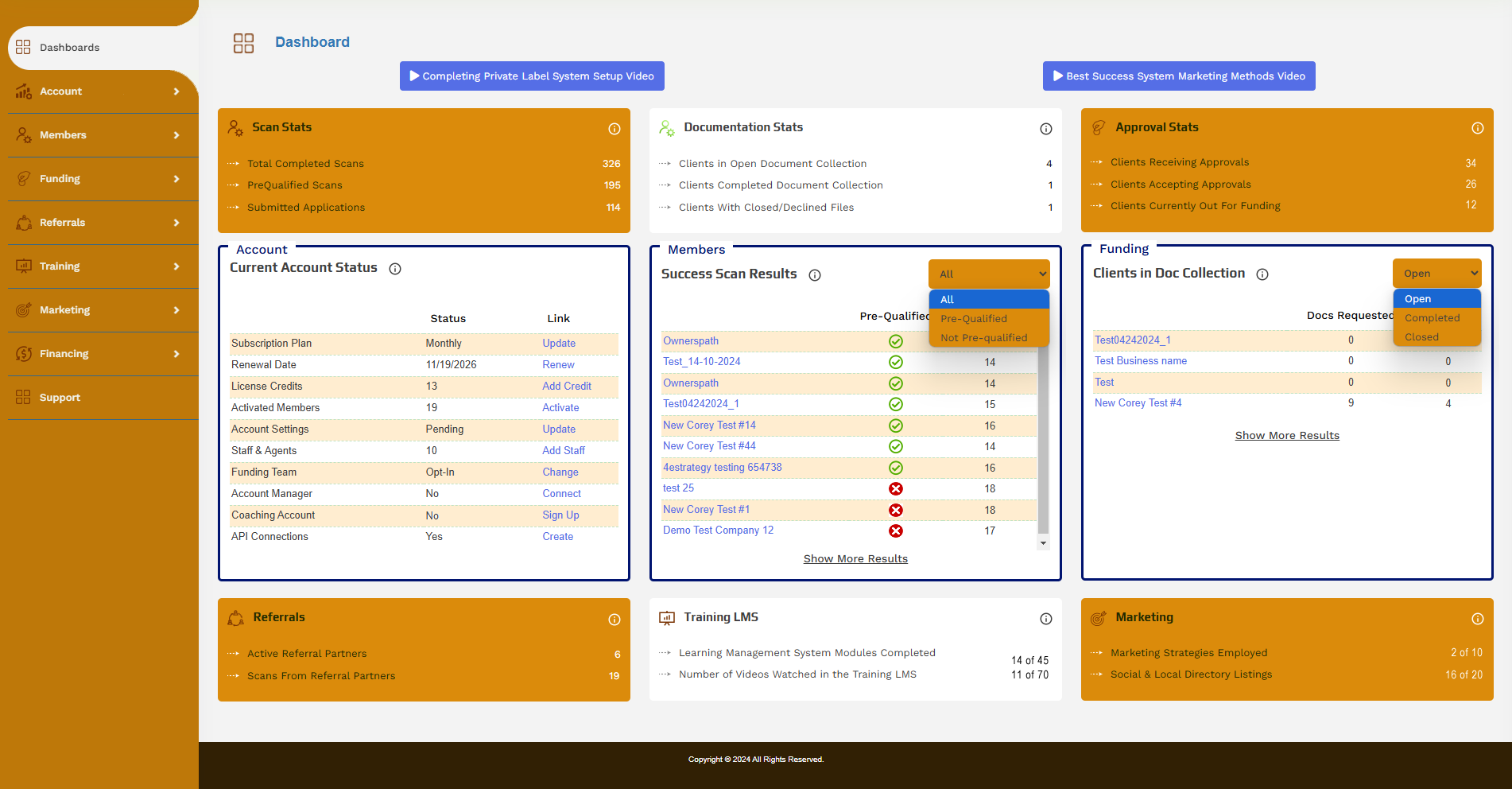

This new dashboard includes easier access to account management items, heads-up display for completed scans, pre-quals, applications and document collection status. The three center panels are more compact for better access with the other six panels showing the following displays:

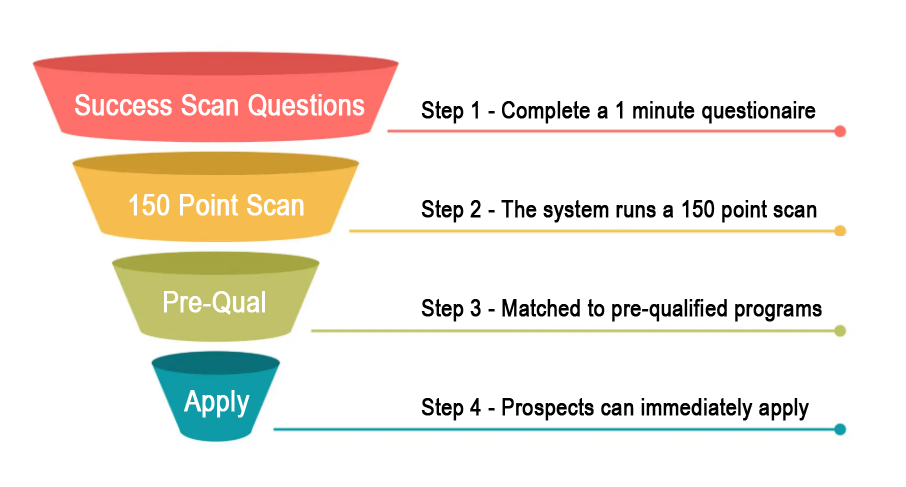

- Completed Scan Stats

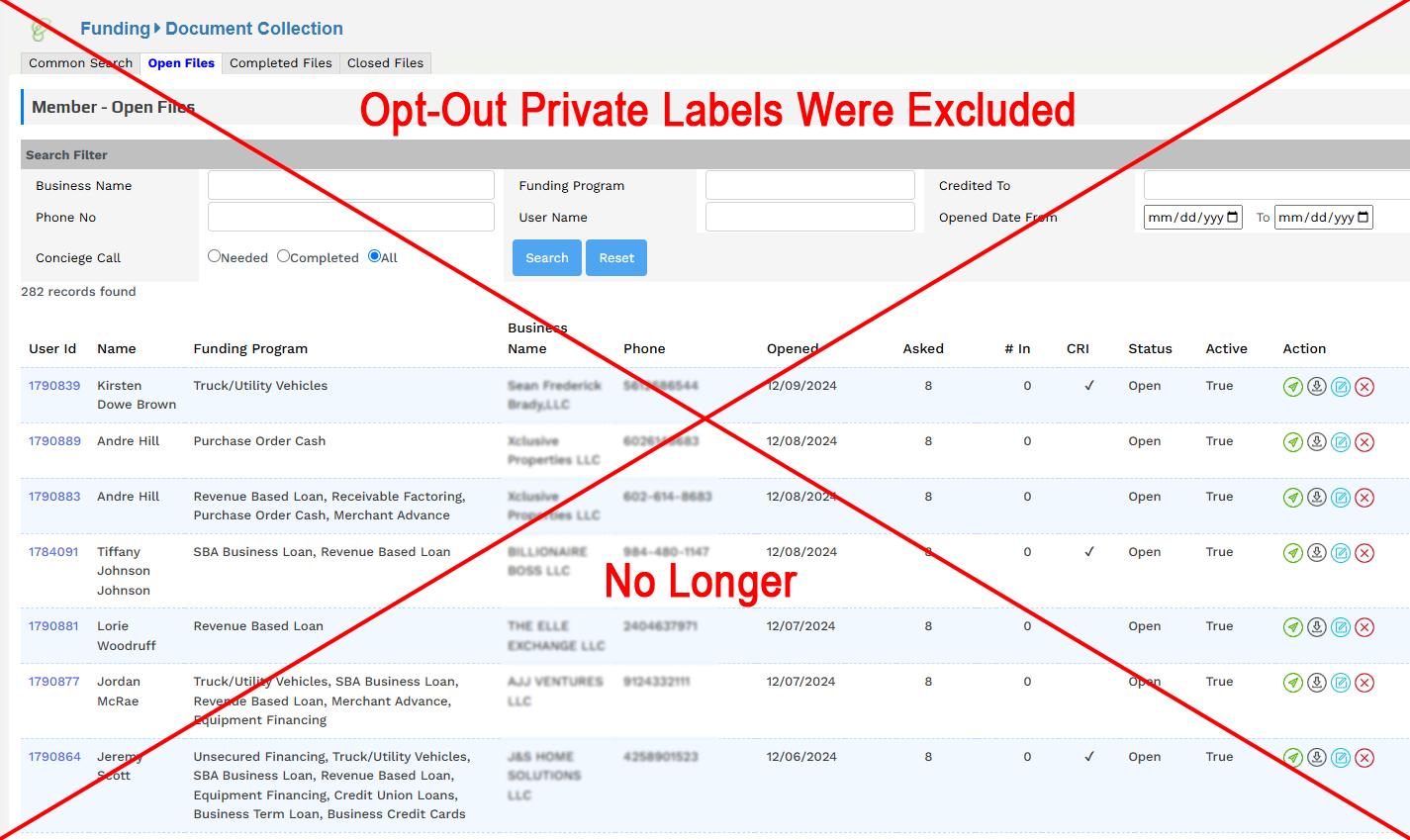

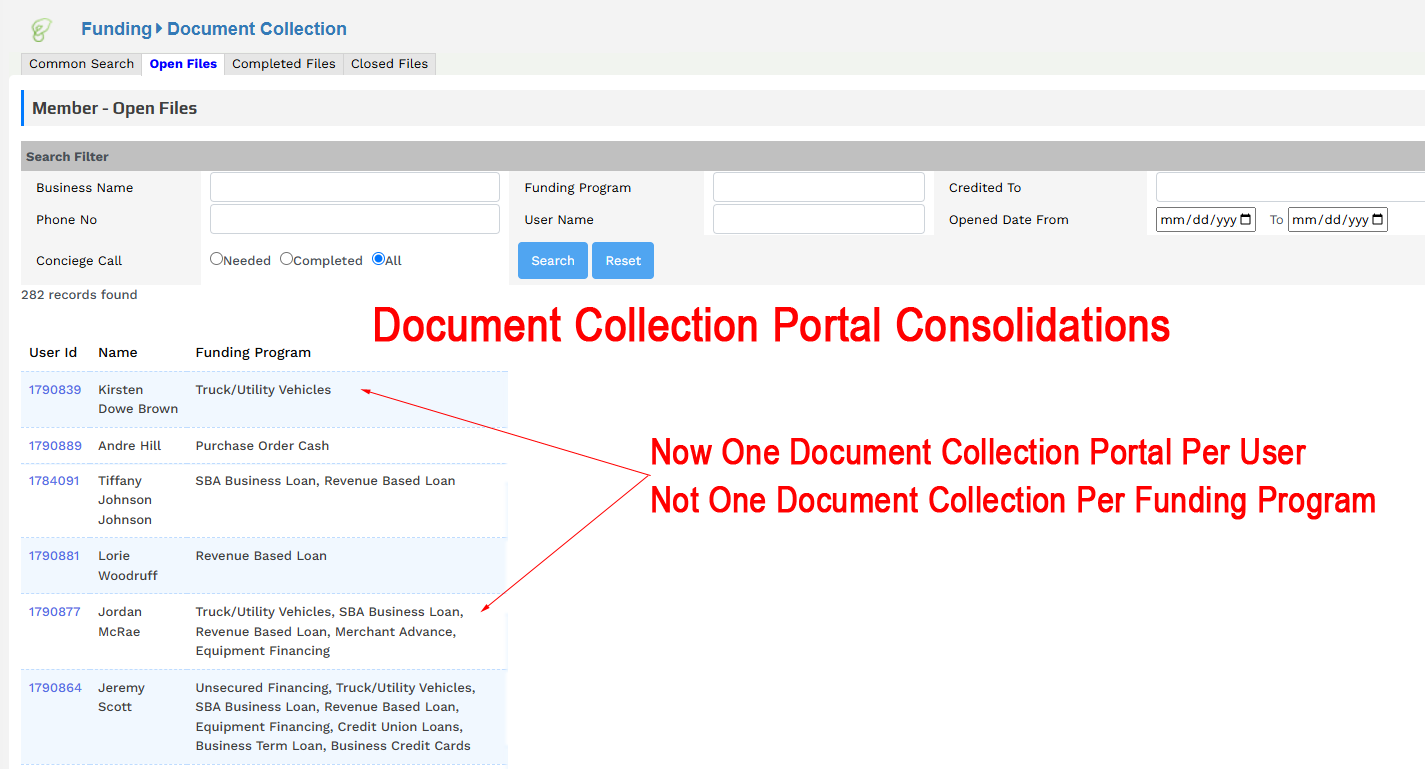

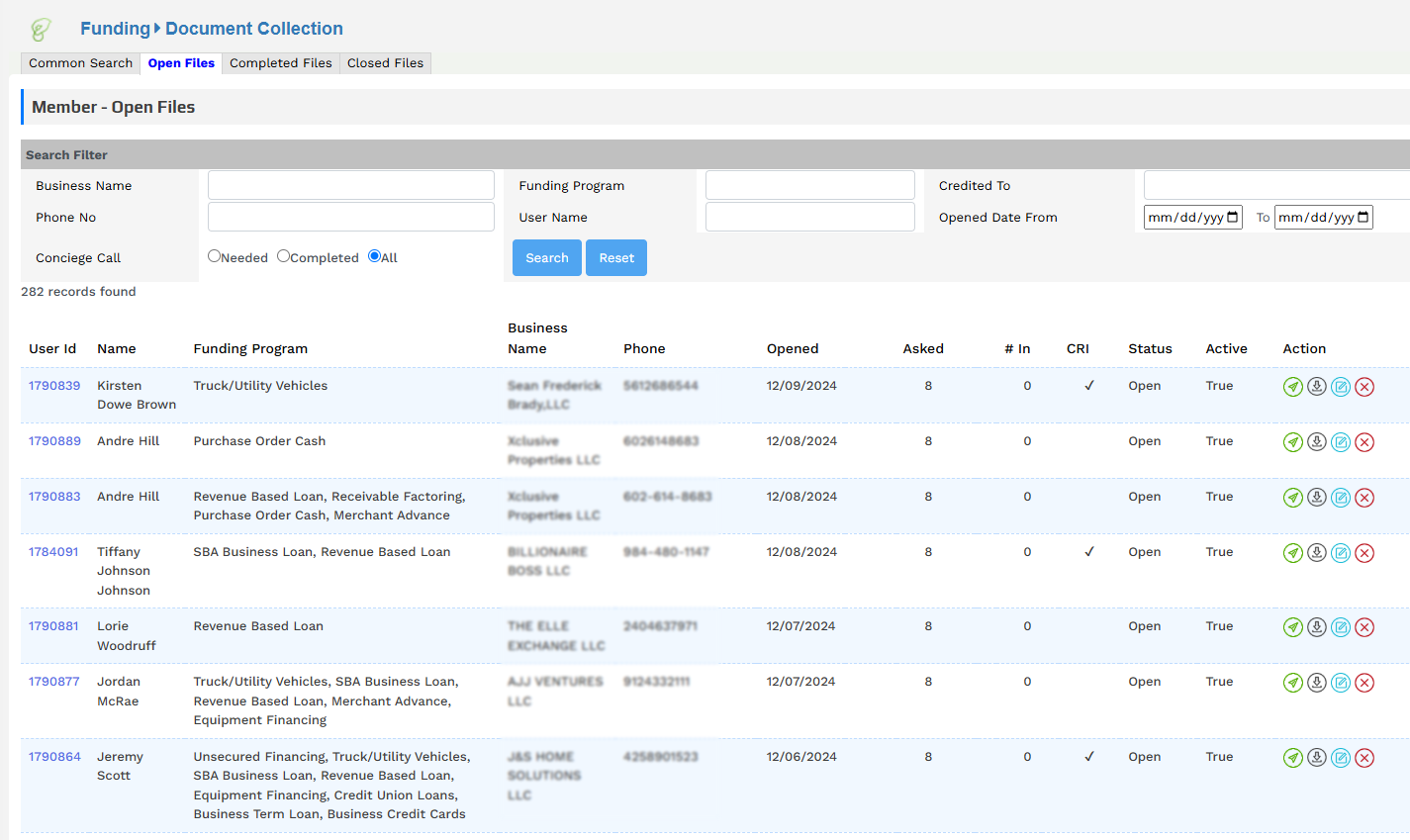

- Document Collection Stats

- Funding Approval Stats

- Referral Partner activity

- Training LMS Progress

- Marketing Program Usage